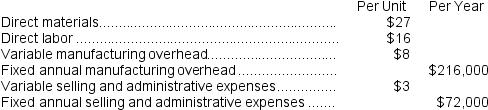

The management of Musselman Corporation would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing. The company's accounting department has supplied the following estimates for the new product:

Management plans to produce and sell 9,000 units of the new product annually. The new product would require an investment of $1,305,000 and has a required return on investment of 10%.

Management plans to produce and sell 9,000 units of the new product annually. The new product would require an investment of $1,305,000 and has a required return on investment of 10%.

-The markup percentage on absorption cost is closest to:

Definitions:

Price-Taker Model

A market situation where individual firms are unable to influence the prices of goods or services they sell and must therefore accept the market price set by supply and demand forces.

Price-Taker Firm

A business that has no control over the market price of its products and must accept the prevailing market price.

Economic Profit

The difference between a firm's total revenue and its total costs, including both explicit and opportunity costs.

Q5: Saulsberry Corporation manufactures numerous products,one of which

Q10: The income tax expense in year 3

Q27: Suppose that Division S can sell all

Q38: Assume that the Valve Division has enough

Q42: Variable service department costs should be charged

Q49: Return on investment (ROI)equals margin multiplied by

Q49: Farrugia Corporation produces two intermediate products,A and

Q121: The present value of the annual cost

Q123: The raw materials quantity variance for the

Q126: The net present value of the entire