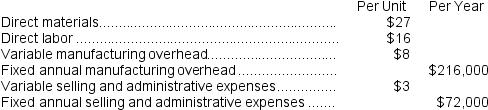

The management of Musselman Corporation would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing. The company's accounting department has supplied the following estimates for the new product:

Management plans to produce and sell 9,000 units of the new product annually. The new product would require an investment of $1,305,000 and has a required return on investment of 10%.

Management plans to produce and sell 9,000 units of the new product annually. The new product would require an investment of $1,305,000 and has a required return on investment of 10%.

-The unit target selling price using the absorption costing approach is closest to:

Definitions:

Fundamental Attribution Error

The tendency to overemphasize personal characteristics and ignore situational factors in explaining others' behavior.

Overjustification Effect

A phenomenon where providing external incentives for an activity already intrinsically rewarding leads to a decrease in intrinsic motivation.

Contingent Reward

A reinforcement strategy where rewards are given based on the achievement of specific criteria or performance.

Self-Perception Errors

Mistakes made when individuals evaluate their own behavior and qualities, often leading to inaccuracies in self-assessment.

Q12: Hennig Plastics Equipment Corporation has developed a

Q16: Timdat Corporation,a manufacturer of moderate-priced time pieces,would

Q42: Infante Corporation has provided the following information

Q48: The net present value of the entire

Q72: Galati Corporation has provided the following information

Q107: Olis Corporation is considering a capital budgeting

Q117: Ariel Corporation has provided the following information

Q134: In net present value analysis,the release of

Q156: Suppose Deed Corporation evaluates managerial performance using

Q188: The management of Furrow Corporation is considering