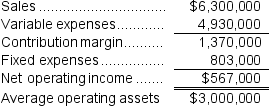

Robichau Inc. reported the following results from last year's operations:

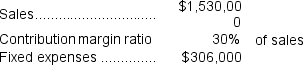

At the beginning of this year, the company has a $900,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $900,000 investment opportunity with the following characteristics:

The company's minimum required rate of return is 20%.

The company's minimum required rate of return is 20%.

-If the company pursues the investment opportunity and otherwise performs the same as last year,the combined ROI for the entire company will be closest to:

Definitions:

Fourth Amendment

A constitutional amendment in the United States protecting citizens against unreasonable searches and seizures by the government.

Self-Incrimination Clause

A provision in the Fifth Amendment of the U.S. Constitution that protects individuals from being forced to testify against themselves during criminal proceedings.

Subchapter S Corporation

A form of corporation in the U.S. that meets specific Internal Revenue Code requirements and passes income, losses, deductions, and credits to its shareholders for federal tax purposes.

Professional Corporations

A type of corporation for professionals (such as lawyers, doctors, and accountants) that offers certain tax and legal advantages.

Q9: How much Housekeeping Department cost should be

Q10: If variable manufacturing overhead is applied on

Q10: "Cost-plus" pricing means that all costs--manufacturing,selling,and administrative--are

Q46: Bialas Corporation uses a standard cost system

Q55: Suppose that if the Doombug toy is

Q74: As defined it the text,the ending balance

Q82: After introducing the product,the company finds that

Q97: In a decision between selling B at

Q99: The labor rate variance for the month

Q138: Secore Robotics Corporation has developed a new