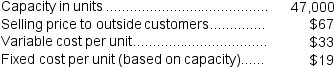

(Appendix 11A) Oberley Products, Inc., has a Receiver Division that manufactures and sells a number of products, including a standard receiver that could be used by another division in the company, the Industrial Products Division, in one of its products. Data concerning that receiver appear below:

The Industrial Products Division is currently purchasing 5,000 of these receivers per year from an overseas supplier at a cost of $58 per receiver.

The Industrial Products Division is currently purchasing 5,000 of these receivers per year from an overseas supplier at a cost of $58 per receiver.

-Assume that the Valve Division is selling all of the valves it can produce to outside customers.Also assume that $6 in variable expenses can be avoided on transfers within the company due to reduced shipping and selling costs.What should be the minimum acceptable transfer price for the valves from the standpoint of the Valve Division?

Definitions:

Functional

Pertains to the practical or utilitarian aspects of something, emphasizing its purpose or role rather than its aesthetics.

Produce

To create or manufacture goods or products, often on a large scale.

Centralized

A system or organizational structure where decision-making and control are concentrated in a single point or at a high level.

Decentralized

Pertains to the distribution of functions, powers, people, or things away from a central location or authority.

Q3: Fabbri Wares is a division of a

Q18: For performance evaluation purposes,how much of the

Q24: The labor rate variance for the month

Q73: Segers Corporation manufactures one product.It does not

Q81: If the company pursues the investment opportunity

Q93: Land held for possible plant expansion would

Q105: The fixed overhead budget variance is:<br>A) $16,000

Q105: Sade Inc.has provided the following data concerning

Q128: Goolden Electronics Corporation has a standard cost

Q146: Which of the following would not be