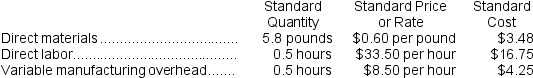

Puvo, Inc., manufactures a single product in which variable manufacturing overhead is assigned on the basis of standard direct labor-hours. The company uses a standard cost system and has established the following standards for one unit of product:

During March, the following activity was recorded by the company:

During March, the following activity was recorded by the company:

• The company produced 2,400 units during the month.

• A total of 19,400 pounds of material were purchased at a cost of $13,580.

• There was no beginning inventory of materials on hand to start the month; at the end of the month, 3,620 pounds of material remained in the warehouse.

• During March, 1,090 direct labor-hours were worked at a rate of $30.50 per hour.

• Variable manufacturing overhead costs during March totaled $14,061.

The direct materials purchases variance is computed when the materials are purchased.

-The materials price variance for March is:

Definitions:

Normal Credit Balance

The expected balance on the credit side of an account, indicating an increase in liabilities, revenue, or equity.

Sales Discounts

Reductions in the selling price offered by a seller to encourage prompt payment by the buyer.

Sales Returns

Transactions involving the return of goods by customers, which reduce the total sales revenue.

Discount Period

The time frame within which a buyer can pay less than the full amount due on an invoice due to early payment incentives offered by the seller.

Q38: Schapp Corporation keeps careful track of the

Q44: For performance evaluation purposes,any variance over budgeted

Q74: As defined it the text,the ending balance

Q83: The budgeted fixed manufacturing overhead cost was:<br>A)

Q107: The variable overhead efficiency variance for November

Q114: Given the following data:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2580/.jpg" alt="Given the

Q122: Which of the following would be an

Q123: When recording the raw materials used in

Q130: Loos Corporation uses a standard cost system

Q323: Higgs Enterprise's flexible budget cost formula for