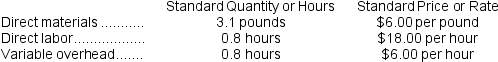

Galeazzi Corporation makes a product with the following standard costs:

In October the company produced 3,000 units using

In October the company produced 3,000 units using

8,380 pounds of the direct material and 2,610 direct labor-hours.During the month,the company purchased 9,500 pounds of the direct material at a total cost of $55,100.The actual direct labor cost for the month was $48,546 and the actual variable overhead cost was $16,965.The company applies variable overhead on the basis of direct labor-hours.The direct materials purchases variance is computed when the materials are purchased.

Required:

a.Compute the materials quantity variance.

b.Compute the materials price variance.

c.Compute the labor efficiency variance.

d.Compute the labor rate variance.

e.Compute the variable overhead efficiency variance.

f.Compute the variable overhead rate variance.

Definitions:

Q47: A company has a standard cost system

Q53: Ricardo Products,Inc.,has a Motor Division that manufactures

Q82: Assume that Division A has ample idle

Q85: What is the maximum price that the

Q119: Yordy Corporation manufactures one product.It does not

Q122: The ending balance in the Retained Earnings

Q130: The variable overhead rate variance for June

Q149: The labor efficiency variance for October is:<br>A)

Q181: The materials price variance for November is:<br>A)

Q209: The net operating income in the flexible