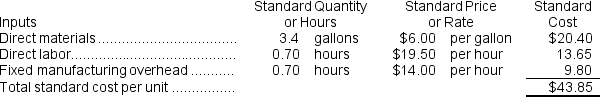

Colbeck Corporation uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.The standard cost card for the company's only product is as follows: During the year,the company purchased 68,000 gallons of raw material at a price of $5.40 per gallon and used 62,660 gallons of the raw material to produce 18,400 units of work in process.

During the year,the company purchased 68,000 gallons of raw material at a price of $5.40 per gallon and used 62,660 gallons of the raw material to produce 18,400 units of work in process.

Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net) .All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When recording the raw materials used in production,the Raw Materials inventory account will increase (decrease) by:

Definitions:

Progressive

Pertaining to a form of taxation in which the tax rate increases as the taxable amount increases, typically applied to income tax.

Regressive

A term describing a tax system where the tax rate decreases as the taxable amount increases, imposing a greater burden on lower-income earners.

Federal Taxes

Taxes levied by the federal government on income, investments, and goods and services, which fund national programs and services.

State And Local Taxes

Taxes levied by individual states and localities, which can include income, sales, property, and other types of taxes.

Q38: Emanuele Incorporated makes a single product--a critical

Q64: The division's turnover is closest to:<br>A) 13.16<br>B)

Q72: The fixed component of the predetermined overhead

Q101: When recording the raw materials used in

Q109: When applying fixed manufacturing overhead to production

Q157: Becka Inc.has provided the following data concerning

Q178: The labor rate variance for January is:<br>A)

Q244: Lido Company's standard and actual costs per

Q303: Herlocker Corporation is a shipping container refurbishment

Q371: Fixed costs should usually be included in