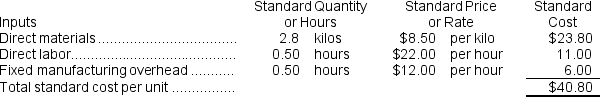

Phann Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $90,000 and budgeted activity of 7,500 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $90,000 and budgeted activity of 7,500 hours.

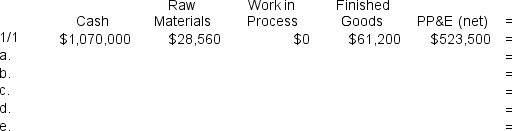

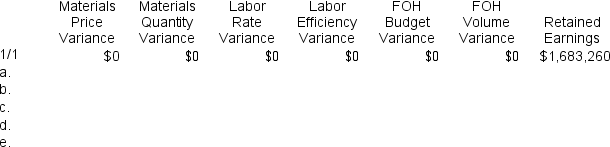

During the year, the company completed the following transactions:

a. Purchased 59,000 kilos of raw material at a price of $9.20 per kilo.

b. Used 51,340 kilos of the raw material to produce 18,300 units of work in process.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 8,850 hours at an average cost of $23.70 per hour.

d. Applied fixed overhead to the 18,300 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $79,400. Of this total, $22,400 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $57,000 related to depreciation of manufacturing equipment.

e. Completed and transferred 18,300 units from work in process to finished goods.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

-When the work in process is completed and transferred to finished goods in transaction (e) above,the Finished Goods inventory account will increase (decrease) by:

Definitions:

Finished Goods Inventory

The total value of all completed products that are ready for sale but have not yet been sold.

Direct Materials Budget

An estimation of the raw materials required for production and their anticipated costs, aiding in financial planning and control.

Cash Payments

Cash payments are transactions in which money is transferred from one party to another to settle a debt or purchase goods or services.

Credit Sales

Sales where the customer is allowed to make payment at a later date, extending credit to the buyer.

Q24: The residual income for the Hum Division

Q25: Levar Corporation has two operating divisions--a Consumer

Q58: When the fixed manufacturing overhead cost is

Q66: Assume that the Valve Division is selling

Q76: The labor efficiency variance for the month

Q135: There can be no volume variance for

Q148: At the beginning of last year,Tarind Corporation

Q163: Sherburne Snow Removal's cost formula for its

Q226: Freytag Corporation's variable overhead is applied on

Q359: The net operating income in the planning