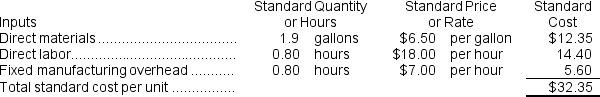

Ester Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $168,000 and budgeted activity of 24,000 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $168,000 and budgeted activity of 24,000 hours.

During the year, the company applied fixed overhead to the 22,600 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $149,800. Of this total, $83,800 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $66,000 related to depreciation of manufacturing equipment.

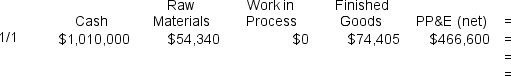

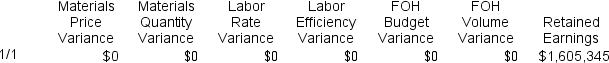

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

-When applying fixed manufacturing overhead to production,the Work in Process inventory account will increase (decrease) by:

Definitions:

Limited Liability

A legal structure that limits the financial liability of investors or owners to the amount they have invested in a company.

Shareholders

Individuals or entities that own one or more shares of stock in a corporation, giving them rights to dividends and a say in company matters through voting.

Creditors

Individuals or institutions to whom money is owed by the debtor for provided goods, services, or loans.

Privately Held Corporation

A privately held corporation is a business entity owned by private investors, shareholders, or company members, and not publicly traded on stock exchanges.

Q9: When recording the direct labor costs,the Work

Q19: The raw materials quantity variance for the

Q26: Gregorich Incorporated makes a single product--a critical

Q35: Taussig Snow Removal's cost formula for its

Q67: Herriot Corporation manufactures one product.It does not

Q80: The net operating income for the year

Q89: Grafton Corporation manufactures one product.It does not

Q163: The variable overhead rate variance is:<br>A) $1,000

Q171: The variable overhead efficiency variance for August

Q333: The spending variance for food and supplies