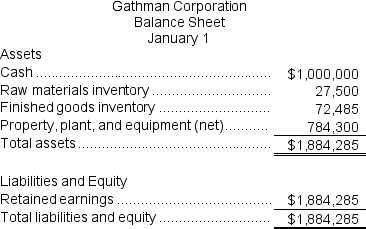

Gathman Corporation manufactures one product.It does not maintain any beginning or ending Work in Process inventories.The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.There is no variable manufacturing overhead.The company's balance sheet at the beginning of the year was as follows:

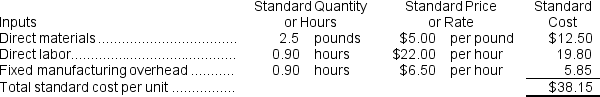

The standard cost card for the company's only product is as follows:

The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $117,000 and budgeted activity of 18,000 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $117,000 and budgeted activity of 18,000 hours.

During the year,the company completed the following transactions:

a.Purchased 36,300 pounds of raw material at a price of $4.70 per pound.

b.Used 32,100 pounds of the raw material to produce 12,800 units of work in process.

c.Assigned direct labor costs to work in process.The direct labor workers (who were paid in cash)worked 12,520 hours at an average cost of $21.00 per hour.

d.Applied fixed overhead to the 12,800 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed.Actual fixed overhead costs for the year were $132,700.Of this total,$27,700 related to items such as insurance,utilities,and indirect labor salaries that were all paid in cash and $105,000 related to depreciation of manufacturing equipment.

e.Transferred 12,800 units from work in process to finished goods.

f.Sold for cash 12,600 units to customers at a price of $52.10 per unit.

g.Completed and transferred the standard cost associated with the 12,600 units sold from finished goods to cost of goods sold.

h.Paid $73,000 of selling and administrative expenses.

i.Closed all standard cost variances to cost of goods sold.

Required:

1.Compute all direct materials,direct labor,and fixed overhead variances for the year.

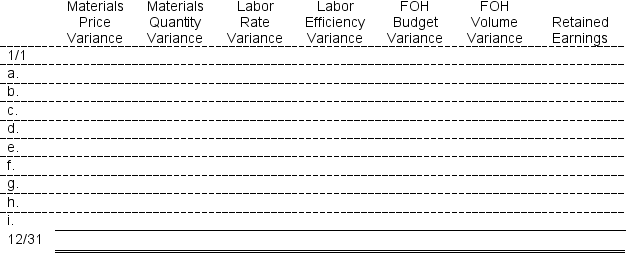

2.Enter the beginning balances and record the above transactions in the worksheet that appears below.Because of the width of the worksheet,it is in two parts.In your text,these two parts would be joined side-by-side to make one very wide worksheet.

3.Determine the ending balance (e.g.,12/31 balance)in each account.

4.Prepare an income statement for the year.

Definitions:

Normally Distributed

Describes a dataset whose distribution forms a symmetrical, bell-shaped curve when plotted, characterized by specific mean and standard deviation values.

Independent

Describes a characteristic of variables in an experiment or study that are not influenced or caused by another variable.

Standard Deviation

An indicator of the diversity or variability within a data set, reflecting how much individual data points differ from the mean.

Normally Distributed

Refers to a probability distribution that is symmetric about the mean, showing that data near the mean are more frequent in occurrence than data far from the mean.

Q8: Woodhouse Corporation manufactures one product.It does not

Q27: The fixed overhead volume variance is:<br>A) $63,495

Q45: Arellanes Corporation manufactures one product.It does not

Q62: When recording the raw materials purchases in

Q106: What is ChocO's labor rate variance?<br>A) $902

Q150: A revenue variance is unfavorable if the

Q180: The activity variance for net operating income

Q262: The activity variance for manufacturing overhead in

Q376: A budget that is based on the

Q406: A revenue variance is favorable if the