Samples Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead.

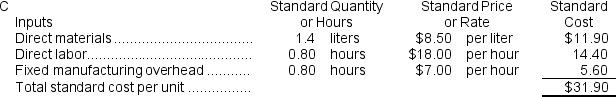

The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $140,000 and budgeted activity of 20,000 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $140,000 and budgeted activity of 20,000 hours.

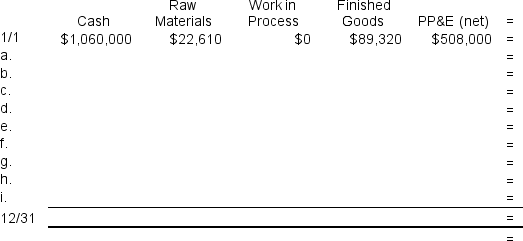

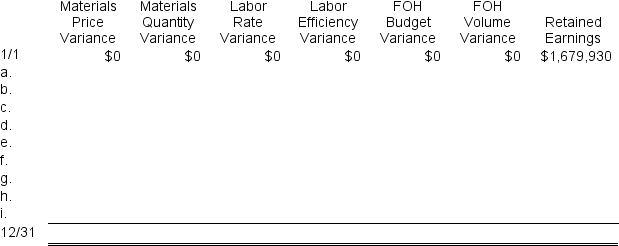

During the year, the company completed the following transactions:

a. Purchased 49,500 liters of raw material at a price of $8.00 per liter. The materials price variance was $24,750 F.

b. Used 45,820 liters of the raw material to produce 32,800 units of work in process. The materials quantity variance was $850 F.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 28,440 hours at an average cost of $17.00 per hour. The direct labor rate variance was $28,440 F. The labor efficiency variance was $39,600 U.

d. Applied fixed overhead to the 32,800 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $154,700. Of this total, $83,700 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $71,000 related to depreciation of manufacturing equipment. The fixed manufacturing overhead budget variance was $14,700 U. The fixed manufacturing overhead volume variance was $43,680 F.

e. Completed and transferred 32,800 units from work in process to finished goods.

f. Sold (for cash) 32,000 units to customers at a price of $38.20 per unit.

g. Transferred the standard cost associated with the 32,000 units sold from finished goods to cost of goods sold.

h. Paid $133,000 of selling and administrative expenses.

i. Closed all standard cost variances to cost of goods sold.

To answer the following questions, it would be advisable to record transactions a through i in the worksheet below. This worksheet is similar to the worksheets in your text except that it has been split into two parts to fit on the page. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

-When the company closes its standard cost variances,the Cost of Goods Sold will increase (decrease) by:

Definitions:

Turnover

In financial terms, it can also refer to the volume of business conducted over a period of time, such as sales turnover.

Operating Assets

Assets that are utilized in the daily operations of a business to generate revenue, excluding investment and non-operational assets.

Margin

The difference between the selling price of a product or service and its cost, often expressed as a percentage of the selling price.

Operating Assets

Assets used by a company in its day-to-day operations to generate revenue, excluding investments and non-operational assets.

Q15: What is the maximum price that the

Q35: Wadding Corporation applies manufacturing overhead to products

Q41: Kropf Inc.has provided the following data concerning

Q47: A company has a standard cost system

Q74: As defined it the text,the ending balance

Q155: For the past year,the turnover used in

Q157: In a flexible budget,when the activity declines,the

Q164: The manufacturing cycle efficiency (MCE)was closest to:<br>A)

Q229: The selling and administrative expenses in the

Q399: Loughry Catering uses two measures of activity,jobs