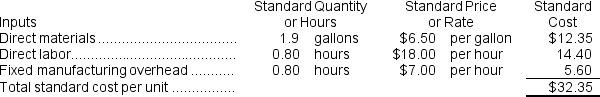

Ester Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $168,000 and budgeted activity of 24,000 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $168,000 and budgeted activity of 24,000 hours.

During the year, the company applied fixed overhead to the 22,600 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $149,800. Of this total, $83,800 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $66,000 related to depreciation of manufacturing equipment.

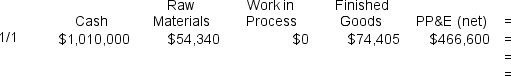

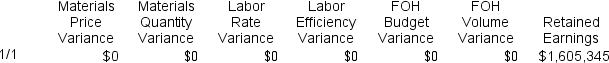

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

-When the fixed manufacturing overhead cost is recorded,which of the following entries will be made?

Definitions:

Moving Average

A statistical technique used to smooth out short-term fluctuations and highlight longer-term trends in data, often used in stock market analysis.

Fundamental Analysts

Investment professionals who evaluate securities by analyzing various factors like economic, financial, and other qualitative and quantitative factors.

Technical Analysts

Specialists who use historical price data and chart patterns to predict future market movements and trends.

Price Movements

The fluctuations in the price of securities in the financial markets.

Q2: The activity variance for revenue is favorable

Q7: Zaino Corporation manufactures one product.It does not

Q22: The Parts Division of Nydron Corporation makes

Q35: In service department cost allocations,sales dollars should

Q55: When the fixed manufacturing overhead cost is

Q56: Gersbach Corporation manufactures one product.It does not

Q130: The delivery cycle time was:<br>A) 30.6 hours<br>B)

Q190: The activity variance for net operating income

Q206: The labor efficiency variance for the month

Q342: The amount shown for "Employee salaries and