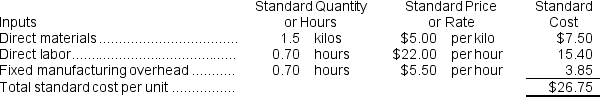

Lusher Corporation manufactures one product.It does not maintain any beginning or ending Work in Process inventories.The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.There is no variable manufacturing overhead.The standard cost card for the company's only product is as follows:

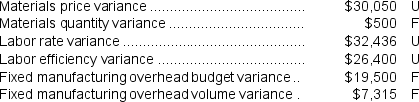

The company calculated the following variances for the year:

The company calculated the following variances for the year:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $134,750 and budgeted activity of 24,500 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $134,750 and budgeted activity of 24,500 hours.

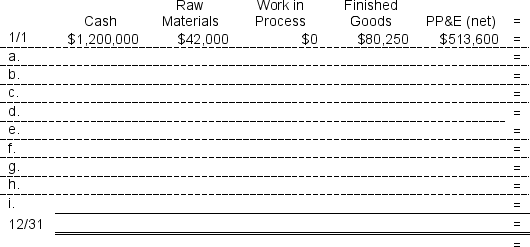

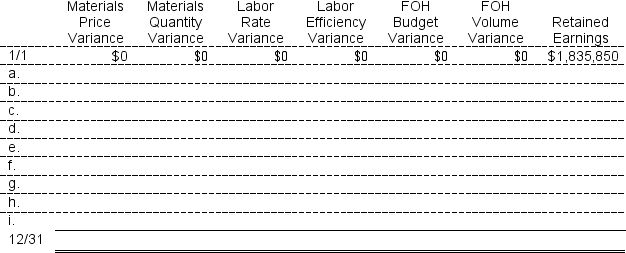

During the year,the company completed the following transactions:

a.Purchased 60,100 kilos of raw material at a price of $5.50 per kilo.

b.Used 55,250 kilos of the raw material to produce 36,900 units of work in process.

c.Assigned direct labor costs to work in process.The direct labor workers (who were paid in cash)worked 27,030 hours at an average cost of $23.20 per hour.

d.Applied fixed overhead to the 36,900 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed.Actual fixed overhead costs for the year were $115,250.Of this total,$40,250 related to items such as insurance,utilities,and indirect labor salaries that were all paid in cash and $75,000 related to depreciation of manufacturing equipment.

e.Transferred 36,900 units from work in process to finished goods.

f.Sold for cash 39,700 units to customers at a price of $33.60 per unit.

g.Completed and transferred the standard cost associated with the 39,700 units sold from finished goods to cost of goods sold.

h.Paid $171,000 of selling and administrative expenses.

i.Closed all standard cost variances to cost of goods sold.

Required:

1.Record the above transactions in the worksheet that appears below.Because of the width of the worksheet,it is in two parts.In your text,these two parts would be joined side-by-side to make one very wide worksheet.The beginning balances have been provided for each of the accounts,including the Property,Plant,and Equipment (net)account which is abbreviated as PP&E (net).

2.Determine the ending balance (e.g.,12/31 balance)in each account.

3.Prepare an income statement for the year.

Definitions:

Computers

Electronic devices capable of executing a set of instructions to perform a vast array of tasks, from basic calculations to complex data processing and analysis.

Comparative Advantage

The ability of an entity to produce a good or service at a lower opportunity cost than another.

Tulips

A type of flowering plant that is widely cultivated for its bright, large, and often colorful flowers.

Comparative Advantage

A concept in economics where a country or entity can produce a good at a lower opportunity cost than another, leading to more efficient trade benefits.

Q29: In a standard costing system,if the actual

Q77: The ending balance in the Cash account

Q84: What is the maximum price that the

Q97: The overhead applied to products during the

Q102: Assume that the Motor Division is selling

Q120: When applying fixed manufacturing overhead to production

Q146: The total cost at the activity level

Q169: The following standards for variable manufacturing overhead

Q185: The labor rate variance for the month

Q193: The raw materials quantity variance for the