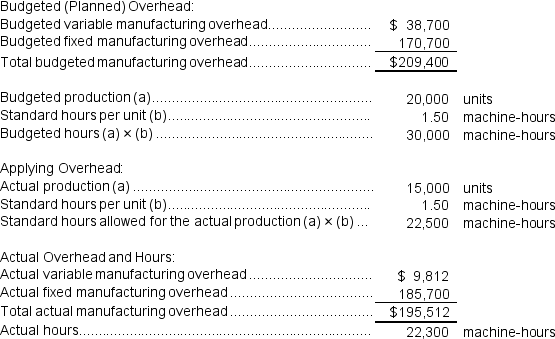

(Appendix 10A) Arca Incorporated makes a single product--a critical part used in commercial airline seats. The company has a standard cost system in which it applies overhead to this product based on the standard machine-hours allowed for the actual output of the period. Data concerning the most recent year appear below:

-The variable overhead efficiency variance is:

Definitions:

Tax Rate

The metric used to figure out the tax obligation of individuals and corporate entities.

Discount Rate

The interest rate charged to commercial banks and other depository institutions on loans they receive from their regional Federal Reserve Bank's lending facility.

Initial Cost

The total expense incurred to acquire an asset or product, including the purchase price and all related fees and taxes, but excluding any subsequent maintenance or operational costs.

Cash Inflows

Money being received by a business or individual, from various sources like sales, investments, or loans.

Q9: When recording the direct labor costs,the Work

Q12: The variable overhead efficiency variance does not

Q24: The labor rate variance for the month

Q46: Pyrdum Corporation produces metal telephone poles.In the

Q52: When recording the raw materials purchases in

Q96: Carattini Incorporated makes a single product--an electrical

Q126: Sakelaris Corporation makes a product with the

Q194: The variable overhead efficiency variance measures the

Q247: Fixed costs should not be included in

Q336: The net operating income in the planning