Feemster Corporation manufactures and sells a single product. The company uses units as the measure of activity in its budgets and performance reports. During October, the company budgeted for 5,900 units, but its actual level of activity was 5,850 units. The company has provided the following data concerning the formulas used in its budgeting and its actual results for October:

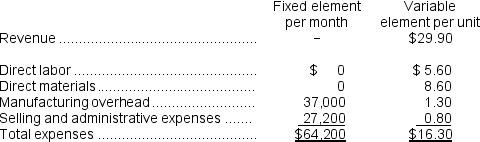

Data used in budgeting:

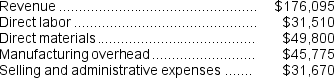

Actual results for October:

Actual results for October:

-The activity variance for direct labor in October would be closest to:

Definitions:

Job-Order Costing System

A cost accounting system that assigns costs to specific batches or job orders, making it easier to track the cost of producing each item or batch.

Overapplied

Occurs when the allocated manufacturing costs exceed the actual manufacturing costs incurred.

Underapplied

Refers to a situation where the allocated or applied costs in an accounting period are less than the actual costs incurred.

Cost of Goods Sold

Represents the total expense incurred from creating or acquiring the goods that a business sells during a period, crucial for evaluating profitability.

Q1: Salem Corporation is conducting a time-driven activity-based

Q1: Sthilaire Corporation is working on its direct

Q47: Appendix 7A)In a Cost Analysis report in

Q52: Mongiello Corporation is conducting a time-driven activity-based

Q59: The beginning inventory for September should be:<br>A)

Q95: The net operating income in the flexible

Q168: Shaak Corporation uses customers served as its

Q176: The fixed overhead budget variance is:<br>A) $20,000

Q395: The activity variance for net operating income

Q404: The net operating income in the planning