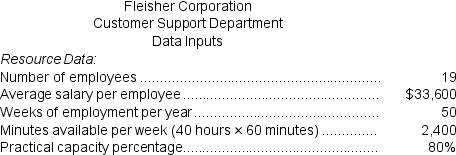

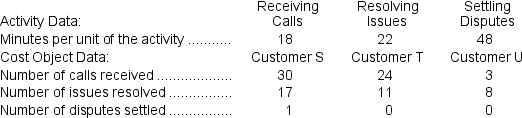

(Appendix 7A) Fleisher Corporation is conducting a time-driven activity-based costing study in its Customer Support Department. The company has provided the following data to aid in that study:

-On the Customer Cost Analysis report in time-driven activity-based costing,the total cost assigned to Customer S would be closest to:

Definitions:

Lifetime Learning Credit

A tax credit available for qualifying tuition and related expenses paid for higher education courses, aimed at promoting lifelong learning.

Qualifying Expenses

Expenses that are approved under tax law as deductible from gross income to reduce taxable income.

AGI Limitations

Thresholds or caps based on Adjusted Gross Income that limit eligibility for certain tax deductions, credits, or benefits.

Credit for The Elderly

A tax credit available to elderly taxpayers or those who are permanently and totally disabled, to reduce their income tax liability.

Q3: Dattilio Corporation manufactures and sells one product.The

Q90: Capes Corporation is a wholesaler of industrial

Q117: What is the unit product cost for

Q119: Bentsen Corporation makes one product. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2580/.jpg"

Q135: When preparing a direct materials budget,the required

Q156: The spending variance for "Refurbishing materials" for

Q192: Wagster Urban Diner is a charity supported

Q229: In its first year of operations,Bronfren Corporation

Q280: The net operating income (loss)under variable costing

Q290: The unit product cost under variable costing