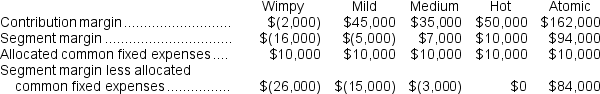

Toxemia Salsa Corporation manufactures five flavors of salsa.Last year,Toxemia generated net operating income of $40,000.The following information was taken from last year's income statement segmented by flavor (brackets indicate a negative amount) : Toxemia expects similar operating results for the upcoming year.If Toxemia wants to maximize its profitability in the upcoming year,which flavor or flavors should Toxemia discontinue?

Toxemia expects similar operating results for the upcoming year.If Toxemia wants to maximize its profitability in the upcoming year,which flavor or flavors should Toxemia discontinue?

Definitions:

Variable Expenses

Costs that change in proportion to the activity of a business.

Fixed Expenses

Expenses that remain constant regardless of the amount of goods produced or sold, including lease payments, wages, and coverage costs.

Net Income

The profit or loss of a business after all expenses, taxes, and costs have been subtracted from total revenues.

Selling Price

The selling price is the amount a buyer pays to purchase a product or service from a seller.

Q16: On the Customer Cost Analysis report in

Q113: Common fixed expenses should not be allocated

Q126: The salary paid to a store manager

Q127: Brockney Inc.bases its manufacturing overhead budget on

Q154: What is the net operating income for

Q158: Depasquale Corporation is working on its direct

Q195: The net operating income (loss)under variable costing

Q202: Stefanovich Corporation makes one product.The company has

Q282: Ruiz Clinic bases its budgets on the

Q283: Lean production should result in reduced inventories.If