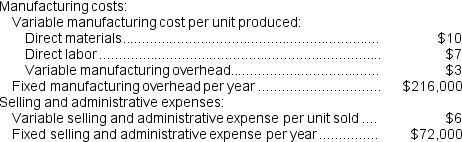

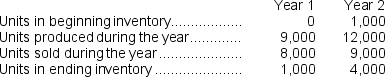

Else Corporation has provided the following data for its two most recent years of operation:

Required:

Required:

a.Assume the company uses absorption costing.Compute the unit product cost in each year.

b.Assume the company uses variable costing.Compute the unit product cost in each year.

Definitions:

Fair Value

Fair value is the estimated price at which an asset or liability could be traded in a fair transaction between willing parties, other than in a forced or liquidation sale.

Bond Investments

Purchasing debt securities issued by corporations or governments, where the investor lends money in exchange for interest payments and the return of the bond's face value at maturity.

Short-Term Debt

Borrowings that are due for repayment within one fiscal year or operating cycle.

Marketable Trading Investments

Financial assets that are purchased with the intention of selling them in the short term to profit from price fluctuations.

Q5: The unit product cost under super-variable costing

Q24: The unit product cost under super-variable costing

Q25: The amount of cash collected during June

Q37: Cobble Corporation produces and sells a single

Q39: On the Capacity Analysis report in time-driven

Q42: The company's overall break-even sales is closest

Q44: What is the company's unit contribution margin?<br>A)

Q84: If the budgeted direct labor time for

Q145: Assuming the LIFO inventory flow assumption,when production

Q230: Bendel Inc.has an operating leverage of 7.3.If