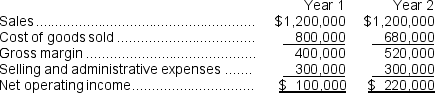

Miller Corporation produces a single product.The company had the following results for its first two years of operation:

In Year 1,the company produced and sold 40,000 units of its only product; in Year 2,the company again sold 40,000 units,but increased production to 50,000 units.The company's variable production cost is $5 per unit and its fixed manufacturing overhead cost is $600,000 a year.Fixed manufacturing overhead costs are applied to the product on the basis of each year's unit production (i.e.,a new fixed manufacturing overhead rate is computed each year).Variable selling and administrative expenses are $2 per unit sold.

In Year 1,the company produced and sold 40,000 units of its only product; in Year 2,the company again sold 40,000 units,but increased production to 50,000 units.The company's variable production cost is $5 per unit and its fixed manufacturing overhead cost is $600,000 a year.Fixed manufacturing overhead costs are applied to the product on the basis of each year's unit production (i.e.,a new fixed manufacturing overhead rate is computed each year).Variable selling and administrative expenses are $2 per unit sold.

Required:

a.Compute the unit product cost for each year under absorption costing and under variable costing.

b.Prepare a contribution format income statement for each year using variable costing.

c.Reconcile the variable costing and absorption costing income figures for each year.

d.Explain why the net operating income for Year 2 under absorption costing was higher than the net operating income for Year 1,although the same number of units were sold in each year.

Definitions:

Social Conformity

the act of altering one's behavior or beliefs to match those of others within a group.

Classic Literature

Timeless works of literature that are recognized as having outstanding or enduring qualities.

Current Events

Happenings or occurrences in the world at the present time, often reported through news or media outlets.

Sincere Performance

The act of genuinely expressing emotions or behavior without the intention to deceive or manipulate others.

Q2: The best estimate of the total variable

Q3: Using the degree of operating leverage,the estimated

Q31: On the Customer Cost Analysis report in

Q70: The net operating income (loss)under absorption costing

Q71: Morine Corporation is conducting a time-driven activity-based

Q81: Break-even analysis assumes that:<br>A) Total revenue is

Q134: Whitmer Corporation is working on its direct

Q143: The management of Merklin Corporation expects sales

Q158: The company's degree of operating leverage is

Q169: Hettrick International Corporation's only product sells for