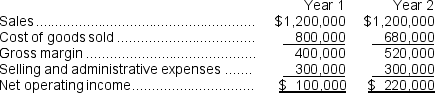

Miller Corporation produces a single product.The company had the following results for its first two years of operation:

In Year 1,the company produced and sold 40,000 units of its only product; in Year 2,the company again sold 40,000 units,but increased production to 50,000 units.The company's variable production cost is $5 per unit and its fixed manufacturing overhead cost is $600,000 a year.Fixed manufacturing overhead costs are applied to the product on the basis of each year's unit production (i.e.,a new fixed manufacturing overhead rate is computed each year).Variable selling and administrative expenses are $2 per unit sold.

In Year 1,the company produced and sold 40,000 units of its only product; in Year 2,the company again sold 40,000 units,but increased production to 50,000 units.The company's variable production cost is $5 per unit and its fixed manufacturing overhead cost is $600,000 a year.Fixed manufacturing overhead costs are applied to the product on the basis of each year's unit production (i.e.,a new fixed manufacturing overhead rate is computed each year).Variable selling and administrative expenses are $2 per unit sold.

Required:

a.Compute the unit product cost for each year under absorption costing and under variable costing.

b.Prepare a contribution format income statement for each year using variable costing.

c.Reconcile the variable costing and absorption costing income figures for each year.

d.Explain why the net operating income for Year 2 under absorption costing was higher than the net operating income for Year 1,although the same number of units were sold in each year.

Definitions:

Business Model

A strategic plan outlining how a company creates, delivers, and captures value in economic, social, cultural, or other contexts.

Market Success

The achievement of desired sales, profit margins, and market share goals within a targeted market or industry.

Dummy Corporation

An entity created to serve as a front or to conceal the true nature of a business transaction, often for legal or financial reasons, without engaging in any real business activities.

Financial Losses

The negative impact on an entity's finances, typically resulting from poor investment decisions, business failures, or unforeseen expenses.

Q4: The net operating income for the year

Q35: What would be the competitor's prediction of

Q53: The break-even point in unit sales is

Q65: Which of the following statements is true

Q67: Sarratt Corporation's contribution margin ratio is 62%

Q69: Under absorption costing,the unit product cost would

Q93: The estimated cost of goods sold for

Q112: What are the Fabrication Department's equivalent units

Q197: Sattler Corporation has provided the following contribution

Q225: Clouthier Corporation has two divisions:<br> Home Division