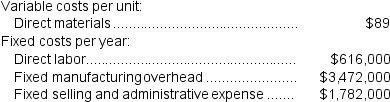

(Appendix 6A) Letcher Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 56,000 units and sold 54,000 units. The company's only product is sold for $227 per unit.

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 56,000 units and sold 54,000 units. The company's only product is sold for $227 per unit.

-The net operating income for the year under super-variable costing is:

Definitions:

Direct Materials

Raw materials that can be directly attributed to the production of goods, considered a variable cost in manufacturing.

Continuous Process

A production process in which raw materials are continuously fed into the process and products are continuously output.

Applied Factory Overhead

Costs indirectly associated with manufacturing, including expenses such as utilities and management salaries, allocated to specific products or departments.

Direct Materials

Raw materials that are directly traceable to the manufacturing of a specific product.

Q19: The company has budgeted to produce 28,000

Q44: What is Casablanca's independent variable?<br>A) the year<br>B)

Q84: Sherwood Corporation has provided the following data

Q91: If the budgeted cash disbursements for selling

Q97: What are the equivalent units for conversion

Q105: An increase in the number of units

Q112: A reason why absorption costing income statements

Q155: The Wholesale Division's break-even sales is closest

Q210: Hopi Corporation expects the following operating results

Q260: Singapore Candy Cane Corporation is a single