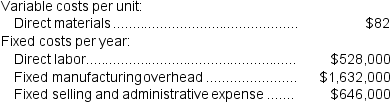

(Appendix 6A) Union Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 24,000 units and sold 17,000 units. The company's only product is sold for $232 per unit.

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 24,000 units and sold 17,000 units. The company's only product is sold for $232 per unit.

-Assume that the company uses an absorption costing system that assigns $22 of direct labor cost and $68 of fixed manufacturing overhead to each unit that is produced.The net operating income under this costing system is:

Definitions:

Interest Payable

A liability account that represents the amount of interest expense that has been incurred but not yet paid to creditors.

Correcting Entries

Adjustments made in accounting records to amend errors or omissions in the previously recorded transactions.

Accumulated Depreciation

The aggregate cost of a tangible asset that has been amortized as a depreciation expense from the time the asset started being used.

Trial Balance

A bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that are equal.

Q14: Villella Corporation is conducting a time-driven activity-based

Q22: What is the total period cost for

Q32: The manufacturing overhead budget of Reigle Corporation

Q44: The total contribution margin for the month

Q89: Toxemia Salsa Corporation manufactures five flavors of

Q123: The contribution margin of the West business

Q149: Shun Corporation manufactures and sells a hand

Q252: Stauffer Corporation has provided the following contribution

Q255: What is the net operating income for

Q260: Which of the following statements is true?<br>A)