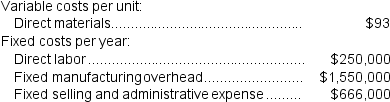

Sawicki Corporation manufactures and sells one product.The following information pertains to the company's first year of operations:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses.During its first year of operations,the company produced 25,000 units and sold 18,000 units.The company's only product is sold for $224 per unit.

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses.During its first year of operations,the company produced 25,000 units and sold 18,000 units.The company's only product is sold for $224 per unit.

Required:

a.Assume the company uses super-variable costing.Compute the unit product cost for the year and prepare an income statement for the year.

b.Assume that the company uses an absorption costing system that assigns $10 of direct labor cost and $62 of fixed manufacturing overhead to each unit that is produced.Compute the unit product cost for the year and prepare an income statement for the year.

Definitions:

Profit Sharing

A company policy of distributing a portion of its profits to its employees as a form of bonus or incentive.

Ownership Interest

A stake or share in the ownership of a business or property, representing a claim on its assets and profits.

Capital Balances

The amounts of capital attributed to each partner's or shareholder's account in a business, showing their equity or ownership stake.

Partnership Income

Partnership Income is the earnings distributed to partners in a partnership based on the agreed-upon proportions, taken from the partnership's total profit.

Q13: The company's net operating income for the

Q18: The order in which the costs of

Q44: The total contribution margin for the month

Q53: Managers can use a variety of methods

Q97: Serfass Corporation's contribution format income statement for

Q103: Langin Corporation has provided the following contribution

Q140: The company's overall break-even sales is closest

Q203: Under variable costing,only variable production costs are

Q252: The unit product cost under absorption costing

Q259: Corbel Corporation has two divisions: Division A