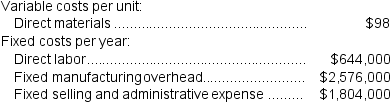

Woodall Corporation manufactures and sells one product.The following information pertains to the company's first year of operations:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses.During its first year of operations,the company produced 46,000 units and sold 44,000 units.The company's only product is sold for $235 per unit.

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses.During its first year of operations,the company produced 46,000 units and sold 44,000 units.The company's only product is sold for $235 per unit.

Required:

a.Assume the company uses super-variable costing.Compute the unit product cost for the year and prepare an income statement for the year.

b.Assume that the company uses a variable costing system that assigns $14 of direct labor cost to each unit that is produced.Compute the unit product cost for the year and prepare an income statement for the year.

c.Assume that the company uses an absorption costing system that assigns $14 of direct labor cost and $56 of fixed manufacturing overhead to each unit that is produced.Compute the unit product cost for the year and prepare an income statement for the year.

d.Prepare a reconciliation that explains the difference between the super-variable costing and variable costing net incomes.

e.Prepare a reconciliation that explains the difference between the super-variable costing and absorption costing net incomes.

Definitions:

Reversible Thinking

The ability to recognize that actions or processes can be undone, leading to the original state or condition.

Centration

A cognitive limitation in early childhood, where a child focuses on one aspect of a situation or object and ignores others.

Formal Operations

The final stage in Piaget's theory of cognitive development, characterized by the ability to think abstractly, reason logically, and manage hypothetical situations.

Sequential

Describes a process that follows a specific order or sequence, where each step or stage comes one after the other in a logical progression.

Q15: Ensley Corporation has provided the following data

Q16: If the sales mix were to shift

Q38: Miller Corporation manufactures a product for which

Q46: Mcconkey Corporation produces and sells a single

Q48: Using the high-low method,the estimate of the

Q70: Mumbower Corporation makes one product and has

Q111: On the Customer Cost Analysis report in

Q172: If sales increase to 6,020 units,the increase

Q251: The February contribution format income statement of

Q259: Corbel Corporation has two divisions: Division A