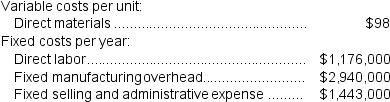

Shelko Corporation manufactures and sells one product.The following information pertains to the company's first year of operations:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses.During its first year of operations,the company produced 42,000 units and sold 37,000 units.The company's only product is sold for $272 per unit.

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses.During its first year of operations,the company produced 42,000 units and sold 37,000 units.The company's only product is sold for $272 per unit.

Required:

a.Assume the company uses super-variable costing.Compute the unit product cost for the year and prepare an income statement for the year.

b.Assume that the company uses an absorption costing system that assigns $28 of direct labor cost and $70 of fixed manufacturing overhead to each unit that is produced.Compute the unit product cost for the year and prepare an income statement for the year.

c.Prepare a reconciliation that explains the difference between the super-variable costing and absorption costing net incomes.

Definitions:

Participative Leadership

A leadership style in which the leader includes team members in the decision-making process, valuing their input and fostering ownership.

Transactional Leadership

A leadership style that focuses on the exchanges between leaders and their followers, where leaders reward or punish followers based on their performance.

Achievement-oriented Leadership

A leadership style focused on setting challenging goals, emphasizing excellence, and demonstrating confidence in followers' abilities.

Directive Leadership

A leadership style where the leader takes a highly structured and authoritative role, making decisions unilaterally and expecting followers to comply.

Q9: The unit product cost under absorption costing

Q36: The net operating income (loss)under absorption costing

Q37: Boiser Corporation is conducting a time-driven activity-based

Q48: A decrease in the number of units

Q76: Iacob Corporation is a wholesaler that sells

Q77: The selling price of Old Corporation's only

Q110: At March 31 Streuling Enterprises,a merchandising firm,had

Q111: Under absorption costing,the unit product cost is:<br>A)

Q252: Stauffer Corporation has provided the following contribution

Q284: Muckleroy Corporation has two divisions: Division K