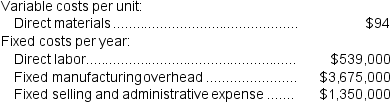

(Appendix 6A) Tremble Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 49,000 units and sold 45,000 units. The company's only product is sold for $233 per unit.

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 49,000 units and sold 45,000 units. The company's only product is sold for $233 per unit.

-The net operating income for the year under super-variable costing is:

Definitions:

FTC

The Federal Trade Commission, a U.S. federal agency tasked with consumer protection and the elimination and prevention of anticompetitive business practices.

State Attorneys General

Chief legal officers of their respective states, responsible for representing the public interest and enforcing the law.

Consumer Protection

Laws and measures designed to safeguard buyers of goods and services against unfair practices in the marketplace.

Point Source Pollution

Pollution that originates from a single, identifiable source or location, such as a pipe, ditch, ship, or factory smokestack.

Q30: Assume that the company uses a variable

Q37: Guillaume Corporation manufactures and sells one product.The

Q45: Younie Corporation has two divisions: the South

Q45: The accounting department of Archer Company,a merchandising

Q50: The high and low points used in

Q98: A properly constructed segmented income statement in

Q168: Succulent Juice Corporation manufactures and sells premium

Q214: Variable expenses in Store K totaled:<br>A) $70,000<br>B)

Q216: Newham Corporation produces and sells two products.In

Q236: Data concerning Bedwell Enterprises Corporation's single product