Dacosta Corporation had only one job in process on May 1. The job had been charged with $1,800 of direct materials, $6,966 of direct labor, and $9,936 of manufacturing overhead cost. The company assigns overhead cost to jobs using the predetermined overhead rate of $18.40 per direct labor-hour.

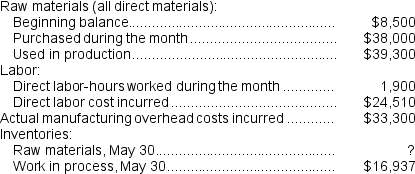

During May, the following activity was recorded:

Work in process inventory on May 30 contains $3,741 of direct labor cost. Raw materials consist solely of items that are classified as direct materials.

Work in process inventory on May 30 contains $3,741 of direct labor cost. Raw materials consist solely of items that are classified as direct materials.

-The entry to dispose of the underapplied or overapplied manufacturing overhead cost for the month would include a:

Definitions:

68-95-99.7 Rule

A statistical rule stating that in a normal distribution, about 68% of observed values fall within one standard deviation, 95% within two, and 99.7% within three standard deviations of the mean.

Normally Distributed

Describes a statistical distribution where data points are symmetrically distributed around the mean, forming a bell-shaped curve.

Standard Deviation

A statistical measure that represents the amount of variation or dispersion from the average in a set of data.

Assignable Cause

A specific factor or reason for variation in a process that can be identified and managed.

Q11: The cost per equivalent unit for conversion

Q12: Walbin Corporation uses the weighted-average method in

Q35: Traeger Woodworking Corporation produces fine cabinets.The company

Q38: What total amount of cost should be

Q63: What are the equivalent units for conversion

Q68: What are the equivalent units for conversion

Q74: What are the equivalent units for conversion

Q180: The amount of overhead applied to Job

Q248: How much is the ending balance in

Q273: Actual overhead costs are not assigned to