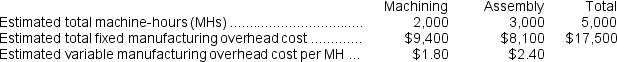

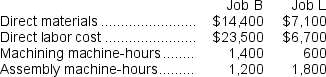

Molash Corporation has two manufacturing departments--Machining and Assembly.The company used the following data at the beginning of the year to calculate predetermined overhead rates: During the most recent month,the company started and completed two jobs--Job B and Job L.There were no beginning inventories.Data concerning those two jobs follow:

During the most recent month,the company started and completed two jobs--Job B and Job L.There were no beginning inventories.Data concerning those two jobs follow: Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments.Further assume that the company uses a markup of 50% on manufacturing cost to establish selling prices.The calculated selling price for Job L is closest to:

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments.Further assume that the company uses a markup of 50% on manufacturing cost to establish selling prices.The calculated selling price for Job L is closest to:

Definitions:

Operating Cycle

A measure of the time span between the purchase of inventory and the collection of cash from accounts receivable, highlighting the time taken for a business to turn its inventory into cash.

Current Liabilities

Short-term financial obligations a company must pay within a year, such as accounts payable, short-term loans, and accrued expenses.

Liquidation

The process of bringing a business to an end and distributing its assets to claimants, often occurring when a company is insolvent and unable to meet its financial obligations.

Operating Cycle

An operating cycle is the average period of time it takes for a business to convert its inventory into cash proceeds from sales.

Q12: Assume that the company uses departmental predetermined

Q14: Zubris Corporation uses the FIFO method in

Q37: Seuell Inc.has provided the following data for

Q42: If 5,000 units are produced,the total amount

Q74: In a traditional format income statement,the gross

Q180: The amount of overhead applied to Job

Q201: If the company marks up its unit

Q287: Henkes Corporation bases its predetermined overhead rate

Q290: A cost incurred in the past that

Q292: Whitlatch Corporation uses a job-order costing system