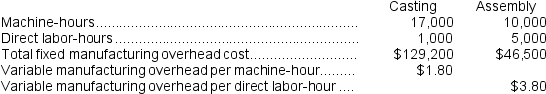

Tiff Corporation has two production departments, Casting and Assembly. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Casting Department's predetermined overhead rate is based on machine-hours and the Assembly Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:

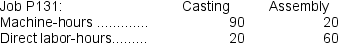

During the current month the company started and finished Job P131. The following data were recorded for this job:

During the current month the company started and finished Job P131. The following data were recorded for this job:

-The amount of overhead applied in the Assembly Department to Job P131 is closest to:

Definitions:

Marginal Social Benefits

The extra advantage obtained by society from the consumption of an additional unit of any product or service.

Positive Externalities

Benefits that are enjoyed by third-parties as a result of an economic transaction or activity, without them directly participating in the transaction.

Pigouvian Tax

A tax imposed on activities that generate negative externalities, aimed at correcting an inefficient market outcome.

Marginal Social Benefits

The incremental benefit the public receives from consuming an additional unit of a good or service.

Q7: The estimated total manufacturing overhead for the

Q19: If the predetermined overhead rate on is

Q33: The management of Schneiter Corporation would like

Q56: The cost of quality training would be

Q89: Within the relevant range,variable costs can be

Q95: Sutter Corporation uses a job-order costing system

Q102: The amount of overhead applied to Job

Q175: The Cost of Goods Manufactured was:<br>A) $19,900<br>B)

Q226: For financial reporting purposes,the total amount of

Q227: For financial reporting purposes,the total amount of