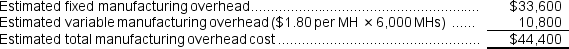

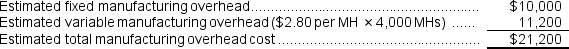

Fee The first step is to calculate the estimated total overhead costs in the two departments.

Machining

Customizing

Customizing

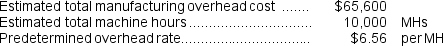

The second step is to combine the estimated manufacturing overhead costs in the two departments ($44,400 + $21,200 = $65,600) to calculate the plantwide predetermined overhead rate as follow:

The second step is to combine the estimated manufacturing overhead costs in the two departments ($44,400 + $21,200 = $65,600) to calculate the plantwide predetermined overhead rate as follow:

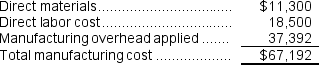

The overhead applied to Job C is calculated as follows:

The overhead applied to Job C is calculated as follows:

Overhead applied to a particular job = Predetermined overhead rate x Machine-hours incurred by the job

= $6.56 per MH x (4,100 MHs + 1,600 MHs)

= $6.56 per MH x (5,700 MHs)

= $37,392

Job C's manufacturing cost:

Reference: CH02-Ref24

Reference: CH02-Ref24

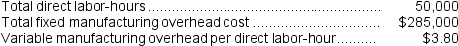

Prather Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on the following data:

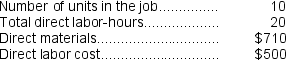

Recently, Job P513 was completed with the following characteristics:

Recently, Job P513 was completed with the following characteristics:

-The amount of overhead applied to Job P513 is closest to:

Definitions:

Receptive Audience

An audience that is open and willing to listen, understand, and accept the message being communicated.

Open-Ended Questions

Inquiries designed to encourage a full, meaningful answer using the respondent's own knowledge and/or feelings, beyond a simple yes or no.

Regulation Authorities

Organizations or governmental bodies responsible for overseeing and enforcing laws and standards within specific industries or sectors to ensure compliance and protect public interests.

Stipulated Requirements

Specific conditions or standards that are explicitly stated and agreed upon, often within a contract or agreement.

Q7: The unit product cost of product N32Y

Q45: If the company marks up its unit

Q60: Dipaola Corporation has provided the following data

Q99: Quiet Corporation uses a job-order costing system

Q162: The cost of goods sold for November

Q166: If the estimated manufacturing overhead for the

Q195: Which of the following approaches to preparing

Q199: The estimated total manufacturing overhead is closest

Q220: Plasencia Corporation is a manufacturer that uses

Q225: During June,Buttrey Corporation incurred $67,000 of direct