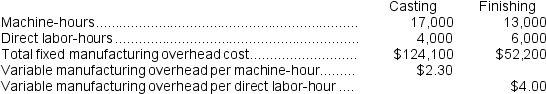

Rocher Corporation has two production departments,Casting and Finishing.The company uses a job-order costing system and computes a predetermined overhead rate in each production department.The Casting Department's predetermined overhead rate is based on machine-hours and the Finishing Department's predetermined overhead rate is based on direct labor-hours.At the beginning of the current year,the company had made the following estimates:

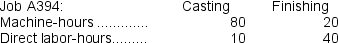

During the current month the company started and finished Job A394.The following data were recorded for this job:

During the current month the company started and finished Job A394.The following data were recorded for this job:

Required:

Required:

a.Calculate the estimated total manufacturing overhead for the Casting Department.

b.Calculate the predetermined overhead rate for the Casting Department.

c.Calculate the amount of overhead applied in the Casting Department to Job A394.

Definitions:

Cross-functional Teams

Groups composed of members from different departments or areas of expertise working together toward a common goal.

Self-managed Teams

Groups of workers who are given the autonomy to manage their own tasks and responsibilities without direct supervision.

Task Forces

Temporary groups established to accomplish a specific objective, often bringing together expertise from different areas.

Cross-functional Teams

Teams composed of members from different departments or functional areas within an organization, working together towards a common goal.

Q19: The predetermined overhead rate (i.e.,activity rate)for Activity

Q45: Cienfuegos Corporation has provided the following data

Q48: If 3,000 units are produced,the total amount

Q62: Which of the following would be classified

Q73: The estimated total manufacturing overhead for the

Q79: What would be the total variable maintenance

Q122: Buckovitch Corporation is a manufacturer that uses

Q146: The amount of overhead applied to Job

Q158: Shantz Corporation has provided the following data

Q245: The balance in the raw materials inventory