(Appendix 2A) Adelberg Corporation makes two products: Product A and Product B. Annual production and sales are 500 units of Product A and 1,000 units of Product B. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.4 direct labor-hours per unit and Product B requires 0.2 direct labor-hours per unit. The total estimated overhead for next period is $68,756.

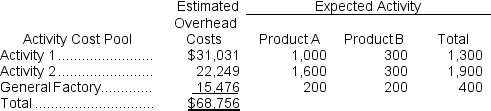

The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and General Factory--with estimated overhead costs and expected activity as follows:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

-The predetermined overhead rate (i.e.,activity rate) for Activity 2 under the activity-based costing system is closest to:

Definitions:

Liability

Legal responsibility for one's actions or inactions, which may result in financial restitution or penalties.

Fiduciary Duty

A legal obligation requiring one party (the fiduciary) to act solely in another party's (the beneficiary's) interest when managing the latter's assets, involving loyalty and care.

Shareholder's Legal Duties

Obligations imposed on shareholders, including acting in the best interest of the corporation and adhering to corporate laws and regulations.

Majority Shareholders

Individuals or entities that own more than half of the total shares of a corporation, giving them significant control over company decisions.

Q6: When the fixed costs of capacity are

Q50: The cost of goods sold for June

Q83: The manufacturing overhead applied is:<br>A) $24,000<br>B) $31,000<br>C)

Q100: The predetermined overhead rate is closest to:<br>A)

Q159: Traditional format income statements are widely used

Q187: Stangl Inc.has provided the following data for

Q192: Longobardi Corporation bases its predetermined overhead rate

Q206: Molin Corporation is a manufacturer that uses

Q247: The unit product cost for Job P978

Q284: Product costs that have become expenses can