(Appendix 2A) Adelberg Corporation makes two products: Product A and Product B. Annual production and sales are 500 units of Product A and 1,000 units of Product B. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.4 direct labor-hours per unit and Product B requires 0.2 direct labor-hours per unit. The total estimated overhead for next period is $68,756.

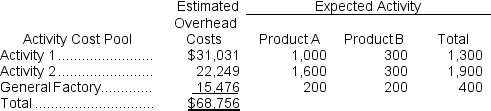

The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and General Factory--with estimated overhead costs and expected activity as follows:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

-The overhead cost per unit of Product B under the activity-based costing system is closest to:

Definitions:

Tax Firm

is a company that specializes in offering tax services, including tax preparation, consultation, and filing for individuals and organizations.

Cost Center

A department or a section of a business that incurs costs but does not directly generate revenues.

Generates Revenues

The process by which a company engages in activities to bring in income from its business operations.

Gross Profit

The difference between revenue and the cost of goods sold before deducting overheads, payroll, taxes, and interest payments.

Q28: How much is the total manufacturing cost

Q36: Which of the following would be classified

Q40: What would be the total appraisal cost

Q82: Materials used in a factory that are

Q122: Buckovitch Corporation is a manufacturer that uses

Q127: Job 652 was recently completed.The following data

Q145: Depreciation on a personal computer used in

Q187: What is the total amount of the

Q209: If 8,000 units are produced,the total amount

Q255: Dearden Corporation uses a job-order costing system