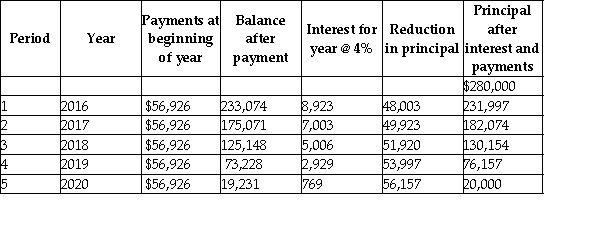

The following amortization schedule is for a lease entered into at the start of fiscal 2016 for an asset that will be useful for 5 years.The company uses straight-line depreciation method.

Required:

Provide the appropriate presentation of this lease in the lessee's balance sheet for December 31,2017,distinguishing amounts that are current from those that are non-current.

Definitions:

Oxygen Consumption

The process by which living organisms utilize oxygen to metabolize organic compounds and produce energy.

Exercise

Physical activity that is planned, structured, and repetitive for the purpose of conditioning any part of the body.

Myoglobin

An oxygen-binding protein found in the muscle tissues of vertebrates, similar to hemoglobin, which stores oxygen for use during muscular activity.

Skeletal Muscle

A type of muscle that is attached to bones and allows movement by contracting and relaxing.

Q10: A socially efficient quantity of a good

Q11: Which of the following will result when

Q30: Give an example of a change in

Q40: Karen works as an emergency-room nurse at

Q51: For each of the following differences between

Q60: Assume that MAK agrees to purchase US$500,000

Q66: Define cash and cash equivalents.

Q71: Which of the following is true with

Q79: Contrast options with warrants.

Q82: If 10,000 shares with par value of