The following data represent the differences between accounting and tax income for Seafood Imports Inc. ,whose pre-tax accounting income is $650,000 for the year ended December 31.The company's income tax rate is 45%.Additional information relevant to income taxes includes the following.

a.Capital cost allowance of $270,000 exceeded accounting depreciation expense of $160,000 in the current year.

b.Rents of $25,000,applicable to next year,had been collected in December and deferred for financial statement purposes but are taxable in the year received.

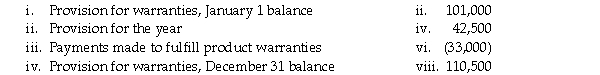

c.In a previous year,the company established a provision for product warranty expense.A summary of the current year's transactions appears below:

For tax purposes,only actual amounts paid for warranties are deductible.

d.Insurance expense to cover the company's executive officers was $6,800 for the year,and you have determined that this expense is not deductible for tax purposes.

Required:

Prepare the journal entries to record income taxes for Seafood Imports.

Definitions:

Breach of Contract

Failure by one or more parties to fulfill the terms and conditions of a contract, which could lead to legal action for enforcement or damages.

UCC

The Uniform Commercial Code represents an extensive collection of regulations that oversee business dealings within the United States.

Accrues

Refers to the accumulation or increase of something over time, often used in financial contexts to describe the accumulation of interest or benefits.

Incidental Damages

Compensation for reasonable expenses directly arising from a breach of contract, not including consequential damages.

Q5: Cindy Corp sold $400,000 of three-year bonds

Q14: A company has a deferred tax liability

Q22: How should subscriptions receivable be reported on

Q23: What is the role of debt rating

Q33: What is the meaning of "contributed capital"?<br>A)This

Q45: If a company provides a non-contributory pension

Q57: For which of the following goods will

Q58: A company issued 95,000 preferred shares and

Q66: From Figure 20-2,we can conclude that to

Q90: What is the tax expense under the