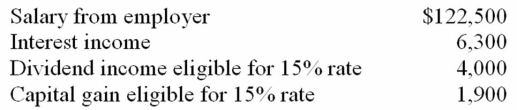

Mr. and Mrs. Daniels had the following income items in 2012:  Mr. and Mrs. Daniels have no dependents and claim the standard deduction. Compute their income tax liability on a joint return.

Mr. and Mrs. Daniels have no dependents and claim the standard deduction. Compute their income tax liability on a joint return.

Definitions:

Surrogacy

An arrangement where a woman carries and delivers a child for another person or couple, often involving legal and contractual agreements.

Contracted Party

An entity or individual that has legally agreed to terms and conditions set forth in a contract with another party.

Ethical Dilemma

A situation in which a difficult choice has to be made between two or more morally correct actions that are in conflict.

Moral Principles

Fundamental beliefs about right and wrong that guide an individual's behavior and decision-making.

Q33: Logan, an Indiana corporation, conducts its international

Q36: Waters Corporation is an S corporation with

Q37: Ms. Knox, age 34 and single, has

Q38: Bart owns 100% of an S corporation

Q51: Carl Meyer, age 56, terminated his employment

Q55: Mr. Adams paid $53,500 in premiums on

Q56: Gifts are not included in the recipient's

Q63: Toffel Inc. exchanged investment land subject to

Q74: Mr. and Mrs. Lansing, who file a

Q93: Many Mountains, Inc. is a U.S. multinational