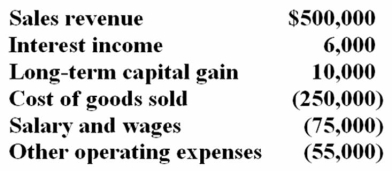

Waters Corporation is an S corporation with two equal shareholders, Mia Jones and David Kerns. This year, Waters recorded the following items of income and expense:  Waters distributed $25,000 to each of its shareholders during the year. Calculate the S corporation's ordinary (non-separately stated) income and indicate which items must be separately stated.

Waters distributed $25,000 to each of its shareholders during the year. Calculate the S corporation's ordinary (non-separately stated) income and indicate which items must be separately stated.

Definitions:

Simon Baron-Cohen

A British clinical psychologist and professor of developmental psychopathology at the University of Cambridge, known for his work on autism spectrum conditions.

Autism Spectrum Disorder

An ailment marked by trouble with engaging socially and effectively communicating, coupled with repetitive behaviors and restricted thought processes.

Poor Communication

A lack of clear and effective exchange of information, where messages may be misunderstood or misinterpreted, leading to confusion and conflicts.

Brain Regions

Specific areas within the brain that have distinct functions or roles, often associated with certain behaviors or physiological processes.

Q14: Noble Inc. paid $310,000 for equipment three

Q28: PPQ Inc. wants to change from a

Q28: Mr. and Mrs. Maxwell and their two

Q34: Which of the following statements about the

Q62: Supplies, Inc. does business in Georgia (6%

Q63: Toffel Inc. exchanged investment land subject to

Q66: Which of the following statements about nontaxable

Q77: Platte River Corporation is a calendar year

Q78: Gwen and Travis organized a new business

Q97: Fleming Corporation, a U.S. multinational, has pretax