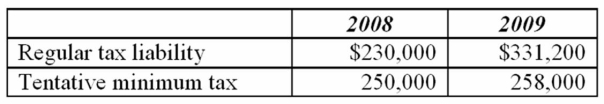

Aloha, Inc. had the following results for its first two years of operation:  Which of the following statements is true?

Which of the following statements is true?

Definitions:

Ordinary Gains

Profits resulting from the sale of assets used in a business's normal operations, subject to regular income tax rates.

Troubled Debt Restructuring

A process where terms of a debt are modified due to the debtor's financial difficulties, often involving a reduction in interest rate or principal owed.

Settlement

The process of resolving a transaction, including the transfer of funds and securities.

Non-interest-bearing Note

A promissory note with no stated interest rate, where the interest is typically implied and calculated based on the difference between the face value and the cash received.

Q23: Which of the following statements concerning the

Q35: Cramer Corporation and Mr. Chips formed a

Q45: A taxpayer who receives boot in a

Q52: Delour Inc. was incorporated in 2004 and

Q80: Mrs. Brinkley transferred business property (FMV $340,200;

Q84: B&I Inc. sold a commercial office building

Q88: A taxpayer who pays boot in a

Q94: Which of the following is a capital

Q97: Firm F purchased a commercial office building

Q98: A cash basis taxpayer must account for