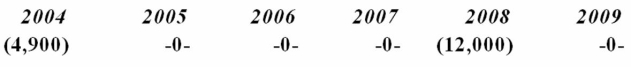

Delour Inc. was incorporated in 2004 and adopted a calendar year. Here is a schedule of Delour's net Section 1231 gains and (losses) reported on its tax returns through 2009.  In 2010, Delour recognized a $50,000 gain on the sale of business land. How is this gain characterized on Delour's tax return?

In 2010, Delour recognized a $50,000 gain on the sale of business land. How is this gain characterized on Delour's tax return?

Definitions:

Business Strategy

A plan of action designed to achieve a long-term or overall aim in the business context.

Merit Raises

A method of increasing an employee's pay based on their performance.

Pay Ranges

Sets of varying salaries that an employer is willing to pay for a particular job, reflecting experience, skill level, and responsibilities.

Merit Bonuses

Financial rewards given to employees based on their performance, achievements, or meeting certain criteria.

Q9: Which of the following statements regarding book/tax

Q17: Which of the following statements about Section

Q42: A casualty loss realized on the destruction

Q48: Tax law uncertainty is the risk that

Q63: Partners may deduct on their individual income

Q63: Betsy Williams is the sole shareholder of

Q69: An affiliated group consists of a parent

Q86: The federal tax law considers the member

Q90: A corporation can't have an increase in

Q101: B&B Inc.'s taxable income is computed as