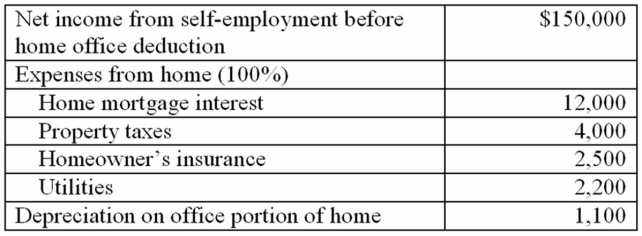

Aaron James has a qualifying home office. The office is 500 square feet and the entire house is 2,500 square feet. Use the following information to determine his allowable home office deduction:

Definitions:

Job Burnout

A state of physical, emotional, or mental exhaustion combined with doubts about competence and the value of work, often due to prolonged stress.

Emotional Labor

The act of handling emotions and their manifestation to comply with a job's emotional expectations.

Ethical Conduct

Behavior in accordance with moral principles and standards that govern an individual's or group's actions within an organization.

Emotional Dissonance

The conflict or strain felt when one's emotions do not align with what is expected or expressed, often encountered in professional settings.

Q6: On December 19, 2012, Acme Inc., an

Q9: Belsap Inc., a calendar year taxpayer, purchased

Q50: Milton Inc. recognized a $16,900 gain on

Q68: Mrs. Tinker paid $78,400 to purchase 15,000

Q73: Inger Associates, which manufactures plastic containers, recently

Q76: Johnson Inc. and C&K Company entered into

Q76: Mr. and Mrs. Pointer each contributed $1,800

Q83: Charlie is single and provides 100% of

Q85: Alexus Inc.'s alternative minimum taxable income before

Q97: Which of the following statements regarding the