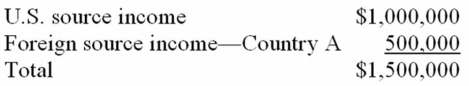

Fleming Corporation, a U.S. multinational, has pretax U.S. source income and foreign source income as follows.  Fleming paid $50,000 income tax to Country A. If Fleming takes the foreign tax credit, compute its worldwide tax burden as a percentage of its pretax income.

Fleming paid $50,000 income tax to Country A. If Fleming takes the foreign tax credit, compute its worldwide tax burden as a percentage of its pretax income.

Definitions:

Future Periods

Time frames or intervals that have yet to occur, often considered in planning and forecasting.

GDP Deflator

An economic metric that converts output measured at current prices into constant-dollar GDP, stripping out the effects of inflation.

Real GDP

Real Gross Domestic Product (GDP) measures the value of all finished goods and services produced within a country's borders in a specific period, adjusted for inflation.

Nominal GDP

Gross Domestic Product measured at current market prices, without adjustment for inflation, representing the value of all goods and services produced over a specific time period.

Q20: Because land is nondepreciable, it is always

Q31: Thunder, Inc. has invested in the stock

Q38: Bart owns 100% of an S corporation

Q45: Limited partners are prohibited by state law

Q57: Mrs. Brinkley transferred business property (FMV $340,200;

Q58: A nonprofit corporation may incur a federal

Q62: When unrelated parties agree to an exchange

Q80: Ruth Darma is a shareholder who is

Q104: The sale of business inventory always generates

Q106: The use of the installment sale method