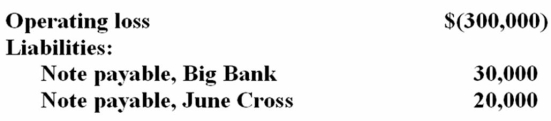

Funky Chicken is a calendar year general partnership with the following current year information:  On January 1 June Cross bought 60% of Funky Chicken for $45,000. She then loaned the partnership $20,000. How much of the operating loss may Cross deduct currently?

On January 1 June Cross bought 60% of Funky Chicken for $45,000. She then loaned the partnership $20,000. How much of the operating loss may Cross deduct currently?

Definitions:

Statute of Frauds

A legal concept that requires certain types of contracts to be in writing and signed by the party to be charged, in order to be legally enforceable.

Indemnity

A security or protection against a loss or other financial burden.

Statute of Frauds

A legal concept that requires certain types of contracts to be in writing and signed by the parties involved to be legally enforceable.

Oral Agreement

An agreement made through spoken communication between parties, which can be legally binding even in the absence of a written document in some cases.

Q25: In computing taxable income, an individual is

Q31: Benlow Company., a calendar year taxpayer, sold

Q31: An individual with $400,000 taxable income has

Q49: This year, Nigle Inc.'s auditors required the

Q52: Delour Inc. was incorporated in 2004 and

Q61: Which of the following is not a

Q63: Partners may deduct on their individual income

Q68: Which of the following statements about the

Q83: Transfer pricing issues arise:<br>A) When tangible goods

Q93: Mr. and Mrs. Reid reported $435,700 ordinary