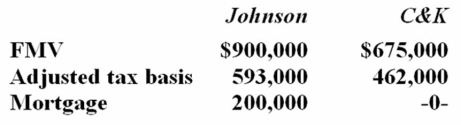

Johnson Inc. and C&K Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property. Compute Johnson's gain recognized on the exchange and its tax basis in the property received from C&K.

Pursuant to the exchange, C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property. Compute Johnson's gain recognized on the exchange and its tax basis in the property received from C&K.

Definitions:

Cultural Heritage

The legacy of physical artifacts and intangible attributes of a group or society inherited from past generations, preserved for future generations.

Culture

The shared values, traditions, norms, customs, arts, history, folklore, and institutions of a group of people.

Sociohistorical Context

The social and historical setting that influences an event, idea, or concept, providing a backdrop that helps to understand contemporary issues.

Freud's Theory

A set of psychoanalytic theories developed by Sigmund Freud that emphasize the influence of the unconscious mind on behavior.

Q2: Ms. Dorley's regular tax liability on her

Q26: A taxpayer should prefer to pay a

Q41: Multi-State, Inc. does business in two states.

Q48: Private letter rulings and technical advice memoranda

Q57: Which of the following is not one

Q61: Richland Company purchased an asset in 2009

Q66: Cross-crediting allows multinational corporations to use excess

Q72: Merkon Inc. must choose between purchasing a

Q88: Philp Inc. sold equipment with a $132,900

Q97: Fleming Corporation, a U.S. multinational, has pretax