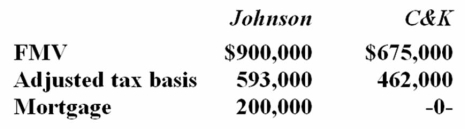

Johnson Inc. and C&K Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property. Compute C&K's gain recognized on the exchange and its tax basis in the property received from Johnson.

Pursuant to the exchange, C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property. Compute C&K's gain recognized on the exchange and its tax basis in the property received from Johnson.

Definitions:

Protein Synthesis

The cellular process of building proteins from amino acids based on genetic instructions encoded in mRNA; involves transcription and translation stages.

Nerve Impulses

The electrical signals that travel along the nerve fibers, facilitating communication within the nervous system.

Muscle Contraction

The process by which muscle fibers shorten and generate force, enabling movement of the body and function of internal organs.

Enzymes

Organic compounds which greatly accelerate the speed of almost every chemical reaction occurring inside cells.

Q9: Funky Chicken is a calendar year general

Q14: In which of the following cases are

Q15: A taxpayer who invests in a growth

Q19: A corporation that is unable to meet

Q20: Tax savings achieved by operating a business

Q50: Chad is the president and sole shareholder

Q61: The after-tax cost of a dollar of

Q69: According to the assignment of income doctrine,

Q88: Westside, Inc. owns 15% of Innsbrook's common

Q89: Which of the following statements about tax