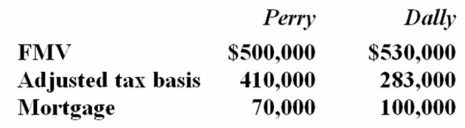

Perry Inc. and Dally Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, Perry assumed the mortgage on the Dally property, and Dally assumed the mortgage on the Perry property. Compute Dally's gain recognized on the exchange and its tax basis in the property received from Perry.

Pursuant to the exchange, Perry assumed the mortgage on the Dally property, and Dally assumed the mortgage on the Perry property. Compute Dally's gain recognized on the exchange and its tax basis in the property received from Perry.

Definitions:

Stability

The state of being resistant to change, or the ability of an object or system to maintain its state when subjected to external forces.

Equilibrium

A state of balance or stability within a system, where competing influences are canceled by others, resulting in no net change.

Allopatric Speciation

The formation of new species through geographical separation, leading to reproductive isolation and genetic divergence.

Genetic Drift

A mechanism of evolution that causes random fluctuations in the frequency of alleles in a population, especially in small populations.

Q6: On December 19, 2012, Acme Inc., an

Q9: Funky Chicken is a calendar year general

Q32: Brace, Inc. owns 90% of West common

Q38: Lorch Company exchanged an old asset with

Q46: Ms. Lewis' maintains a household which is

Q55: Five years ago, Q&J Inc. transferred land

Q69: An affiliated group consists of a parent

Q72: Which of the following is not a

Q83: Transfer pricing issues arise:<br>A) When tangible goods

Q85: O&V sold an asset with a $78,300