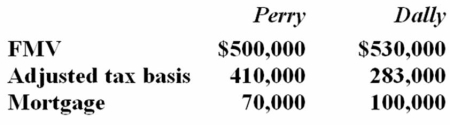

Perry Inc. and Dally Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, Perry assumed the mortgage on the Dally property, and Dally assumed the mortgage on the Perry property. Compute Perry's gain recognized on the exchange and its tax basis in the property received from Dally.

Pursuant to the exchange, Perry assumed the mortgage on the Dally property, and Dally assumed the mortgage on the Perry property. Compute Perry's gain recognized on the exchange and its tax basis in the property received from Dally.

Definitions:

Legal Barriers

Restrictions imposed by law that limit the entry of new firms into an industry or protect existing firms from competition.

Predatory Pricing

A pricing strategy where a company sets prices below cost to eliminate competition and establish a monopoly over time.

Economies of Scale

Cost advantages that enterprises obtain due to their scale of operation, resulting in a reduced cost per unit.

Legal Barriers

Restrictions or regulations established by law that limit entry or operation in certain markets or industries.

Q16: Mr. Weller and the Olson Partnership entered

Q19: A major advantage of an S corporation

Q20: Perry Inc. and Dally Company entered into

Q34: Which of the following statements about the

Q39: The tax basis in property received in

Q71: If a corporation has a high debt-to-equity

Q79: Lilly Inc., a U.S. multinational with a

Q81: Adam and Barbara formed a partnership to

Q88: Mrs. Jansen is the sole shareholder of

Q109: Mr. and Mrs. David file a joint