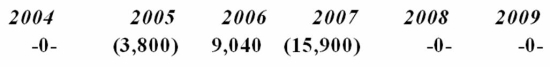

Proctor Inc. was incorporated in 2004 and adopted a calendar year. Here is a schedule of Proctor's net Section 1231 gains and (losses) reported on its tax returns through 2009.  In 2010, Proctor recognized a $25,000 gain on the sale of business land. How is this gain characterized on Proctor's tax return?

In 2010, Proctor recognized a $25,000 gain on the sale of business land. How is this gain characterized on Proctor's tax return?

Definitions:

Guidelines For Good Health

Recommend practices or behaviors that promote physical and mental well-being.

SPF 15+

Designates a level of sun protection factor in sunscreen products that blocks approximately 93% of UVB rays, with the "+" indicating protection above 15.

Use Sunscreen

The practice of applying a lotion or cream that contains compounds to block or absorb ultraviolet (UV) sunlight, protecting the skin from sunburn.

Lumbar Muscles (lower Back)

A group of muscles in the lower back region that support the spine, assist in movement, and maintain posture.

Q31: Southern, an Alabama corporation, has a $7

Q43: BMX Company engaged in a current-year transaction

Q54: Silver Bullet Inc. reported the following for

Q56: Which of the following businesses can't use

Q57: Mrs. Brinkley transferred business property (FMV $340,200;

Q69: Johnson Inc. and C&K Company entered into

Q69: According to the GAAP principle of conservatism,

Q72: Dender Company sold business equipment with a

Q82: Kaskar Company, a calendar year taxpayer, paid

Q92: A reduced market rate of return on