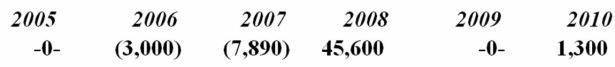

Irby Inc. was incorporated in 2005 and adopted a calendar year. Here is a schedule of Irby's net Section 1231 gains and (losses) reported on its tax returns through 2010.  In 2011, Irby recognized a $14,750 gain on the sale of business land. How is this gain characterized on Irby's tax return?

In 2011, Irby recognized a $14,750 gain on the sale of business land. How is this gain characterized on Irby's tax return?

Definitions:

Abstinence Syndrome

A group of symptoms that occur upon sudden withdrawal from substances to which the body has become dependent, including drugs or alcohol.

Withdrawal Illness

Withdrawal illness refers to the physical and mental symptoms experienced by individuals who cease or reduce the intake of addictive substances to which they have become dependent.

Physical Dependence

A physiological state in which the body adapts to the presence of a drug or substance, leading to withdrawal symptoms when that substance is reduced or ceased.

Psychological Dependence

A condition in which an individual feels a compelling emotional need for a substance or behavior, despite potential negative consequences.

Q7: New York, Inc. owns 100% of Brooklyn,

Q12: Which of the following statements about organizational

Q27: Glover, Inc. had $350,000 of taxable income,

Q39: A limited liability company that has only

Q43: Which of the following statements about tax

Q46: L&P Inc., which manufactures electrical components, purchased

Q86: The federal tax law considers the member

Q90: Corporations report their taxable income and calculate

Q101: B&B Inc.'s taxable income is computed as

Q109: Kopel Company transferred an inventory asset to