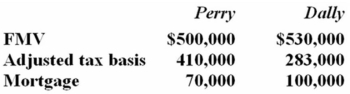

Perry Inc. and Dally Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, Perry assumed the mortgage on the Dally property, and Dally assumed the mortgage on the Perry property. Compute Dally's gain recognized on the exchange and its tax basis in the property received from Perry.

Pursuant to the exchange, Perry assumed the mortgage on the Dally property, and Dally assumed the mortgage on the Perry property. Compute Dally's gain recognized on the exchange and its tax basis in the property received from Perry.

Definitions:

Equivalent Unit

A measure used in cost accounting to represent a portion of a product in terms of a completed unit.

Cost Reconciliation

The process of analyzing and adjusting the differences between reported costs and actual costs, ensuring accuracy in financial reporting.

Partially Completed Production

Inventory that consists of items in the process of being manufactured but are not yet fully completed.

Equivalent Units

A term used in cost accounting to express the amount of materials or labor consumed in terms of fully completed units of output.

Q13: Assume that Congress recently amended the tax

Q14: Every business transaction results in a current

Q23: Which of the following is an example

Q24: The first step in the tax research

Q24: The tax character of an item of

Q31: Mrs. Day structures a transaction to shift

Q50: The rate at which an item of

Q81: Tanner Inc. owns a fleet of passenger

Q90: Kigin Company spent $240,000 to clean up

Q91: Proctor Inc. was incorporated in 2004 and