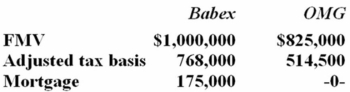

Babex Inc. and OMG Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, OMG assumed the mortgage on the Babex property. Compute OMG's gain recognized on the exchange and its tax basis in the property received from Babex.

Pursuant to the exchange, OMG assumed the mortgage on the Babex property. Compute OMG's gain recognized on the exchange and its tax basis in the property received from Babex.

Definitions:

Under-inflated Steering Tires

Tires on the steering axis that do not have sufficient air pressure, potentially affecting handling and safety.

Over-inflated Tires

Tires filled with air pressure above the manufacturer's recommended levels, potentially causing uneven wear and reduced traction.

Driver Control

Driver control refers to the various systems and mechanisms within a vehicle that allow a driver to operate and manage the vehicle's functions.

Positive Caster

A wheel alignment setting where the steering axis tilts toward the driver, enhancing stability and steering effort at high speeds.

Q11: Mr. Bilboa is a citizen of Portugal.

Q36: Powell Inc. was incorporated and began operations

Q38: Tax evasion is a federal crime punishable

Q46: The after-tax cost of a dollar of

Q52: The use of secondary authorities might be

Q54: Ms. Cregg has a $43,790 basis in

Q57: Which of the following is not one

Q74: Which of the following statements about tax

Q76: The country of Valhalla levies an income

Q103: Irby Inc. was incorporated in 2005 and